-3.png)

Every nonprofit relies on donations, right?

What you might not consider is that every nonprofit also relies on a payment processor, without which the money would never show up in your account.

And it might surprise you to know that you have a great deal of control over your funds: how donations get processed, by whom, and how much you pay to get those donations flowing into your nonprofit's bank account.

CharityEngine has provided fundraising software—including payment processing—to nonprofits of all sizes for more than a decade. While the world of payment processing can seem mysterious, understanding some key concepts can save your nonprofit money and even help you keep more of the funds you're raising.

This article will walk you through the basics and show you where you have some choices, and we'll do it with plain, easy-to-understand language.

Let's begin with a list of terms you might see or hear around the subject of payment processing.

Nonprofit Payment Processing Glossary

Here are key terms you'll hear:

- Merchant Account: A merchant account is an in-between account. It's where money goes when it leaves the donor's bank account but before it's deposited into your nonprofit’s account.

- Aggregator: An aggregator is a type of payment processor, like PayPal. PayPal "aggregates" or collects many payments and processes them through a single merchant account. Every nonprofit using PayPal uses the same merchant account. This offers ease of use but not much customization, flexibility, or speed.

- Payment Processor: A dedicated payment processor is similar to an aggregator, but it sets up a different merchant account for each customer. These processors typically provide faster processing and more flexibility for users. CharityEngine is an example of a dedicated payment processor.

- Payment Gateway: A payment gateway is like a digital cashier. It takes the payment information (like credit card details) from a customer, securely sends it to the bank or payment processor, and then tells the website if the payment was approved or declined.

- PCI Compliance: The Payment Card Industry created a series of standards for companies to ensure the safety of donor data. The standards are updated periodically. If a payment processor is PCI compliant, it means it completes self-assessments to avoid violations.

- PCI Certification: PCI certification is a step above compliance. It involves a rigorous process and a comprehensive audit by a qualified, third-party security assessor to ensure that all proper security measures are taken while processing payments. Using a PCI-certified payment processor (like CharityEngine) is the gold standard.

- Virtual Private Network: A virtual private network (or VPN) is just what it sounds like. It uses encryption to ensure internet security during payment processing, keeping payment data in the hands of the right people and preventing fraudulent payments.

FAQ on Nonprofit Payment Processing

It's normal to have questions when you’re ready to start researching potential payment processors for your nonprofit.

When assessing different payment processing solutions, you should be sure to know the answers to a few essential questions.

How Much Does Payment Processing Cost?

There are a few fees involved in payment processing, and they can be different from system to system. It’s important to understand them so you can compare apples to apples.

- Processing fees are fees that a nonprofit pays for a company to process a transaction.

- Flat fees are charged monthly or annually and they are paid so you can work with the gateway, processor, or aggregator.

- Incidental fees are charged for incidents that occur, such as if a donor’s credit card is declined.

Payment processing fees can add up and vary between providers. If you use an online donation tool or a front-end button connected to forms that receive data, the first fee is usually 1-2% of the donation.

Unless you have a system that combines the donation tool and the payment processor, you’re looking at another fee for the payment processor, which can be 3-5% of the donation.

To sum it up, you can pay up to 7% of each donation to different middlemen if you don’t shop around.

Look for software that offers a donation tool and payment processing in the same software. The more parties involved, the higher the fees you’ll pay.

How Do I Choose a Nonprofit Payment Processor?

Let’s talk about deciding whether you want a payment processor, a nonprofit CRM that integrates with a payment processor, or more of an all-in-one solution.

You might want a payment processor, like PayPal, iATS, or Stripe, if:

- Your annual donation amounts are relatively low (less than $25,000)

- You are selling goods to raise funds, such as in an online shop

- You don’t have a large number of donors (fewer than 5,000)

The key feature you want to evaluate with a payment processor is what types of payment they accept. Credit card, ACH, Apple Pay, Google Wallet, cryptocurrency? Do they handle recurring billing?

You might want a CRM that integrates with those payment processors if you:

- Want to be able to collect donor data and insights

- Are collecting donations rather than selling goods

- Have annual donations that amount to about $200,000

You might want an all-in-one CRM that combines payment processing and an online donation tool if you:

- Raise more than $250,000 in donations

- Want to aggregate and analyze donor data

- Want access to various integrated fundraising tools, such as email automation or peer-to-peer capabilities

So what are the key best practices you should remember?

- Always ensure your payment processor is listed on Visa's list of registered service providers.

- The fewer stops between your donor’s wallet and your nonprofit’s bank account, the lower the fees you’ll pay.

- Make sure your donation tool is integrated with your payment processor, that your payment processor is seamlessly integrated with your event software, and that all your systems play together nicely.

- If you choose a solution that requires many integrations with different providers, try to find one that requires as few integrations as possible.

- A comprehensive, all-in-one solution will be the most economical option unless you’re a small nonprofit.

- With any solution, make sure you’re investing in a partner. Make sure they offer training and a help center number you can call at any time.

In the spirit of full disclosure, CharityEngine offers a PCI-certified, SOC 2-certified payment processor and an all-in-one nonprofit CRM. We know the nonprofit landscape well and are committed to educating charities about how to find the most effective solutions that will put the most money back into their mission.

How Does Credit Card Processing for Nonprofits Work?

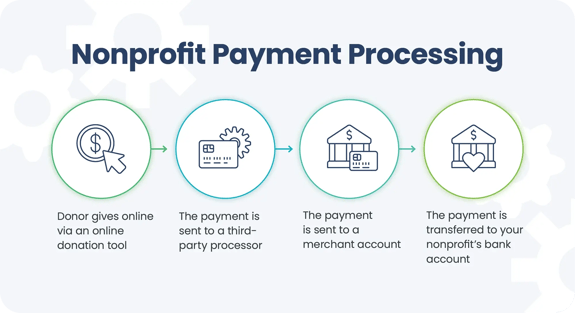

It starts when a donor goes to your website, clicks the “donate now” button, and gives to your cause. It looks something like this:

- The donor’s payment goes through a payment gateway that encrypts and authorizes the payment.

- The payment is sent to a payment processor or aggregator.

- The payment processor will set up different merchant accounts for each of its customers. Your nonprofit will have a designated account, and this donation will go to that account.

- Or, the aggregator uses one general merchant account, not separate ones for each client. This offers ease of use (think PayPal) but not much speed, customization, or flexibility.

- Finally, the donation is transferred to your nonprofit’s bank account.

As you can see, you already have a choice!

Should I Use a Payment Processor or an Aggregator?

Payment processors and aggregators both work as intermediaries to transfer data and funds from your donor’s bank account to your nonprofit’s bank account.

The primary difference between these two nonprofit payment processing methods is the use of the merchant account. Therefore, the processes look somewhat different.

A payment processor's steps look like this:

- First, the donor provides their credit or debit card information on your nonprofit’s online giving page.

- Next, that data is sent through the payment processor’s gateway to the individual merchant account that the processor has set up for your nonprofit.

- Then, the merchant account holds the donation amount while the payment processor verifies the payment information.

- Finally, the donation is transferred from the merchant account to your nonprofit’s bank account.

An aggregator's process looks more like this:

- The first step is the same: the donor provides their credit or debit card information on your nonprofit’s online giving page.

- Next, that data is sent through a payment gateway to an aggregator-controlled merchant account. All of the aggregator’s clients share this account.

- Then, the merchant account holds the donation amount while the aggregator verifies the payment information.

- Finally, the donation is transferred from the merchant account to your nonprofit’s bank account.

If both options get the money from my donor to my nonprofit, does it matter which I choose?

We recommend that clients choose a dedicated payment processor. You want to be somewhat protected in the event of a data breach.

When it comes to the security of donations, customer service matters. During a busy time like end-of-year giving, it can make a big difference in your donations and your reputation.

What's the Difference Between PCI Compliance and PCI Certification?

How can you make sure your payment information and donor data are safe? You don’t want donors to be reluctant to give because they’re worried about security.

The Payment Card Industry (PCI) sets standards to securely handle credit card data. It’s a watchdog of sorts, and most payment processors are either in compliance or certified.

PCI Compliance

As it sounds, PCI-compliant payment processors have complied with the industry's most basic standards. Compliance can be achieved in about a month.

If your payment processor is PCI-compliant:

- It has taken a self-assessment to ensure it follows all of the guidelines.

- It installed a firewall between the wireless network and the cardholder data.

- It has implemented a strong vulnerability management program.

- The security qualifications likely took less than a month to complete.

PCI Certification

PCI-certified payment processors are regularly audited by a third party to ensure the software and security measures are safe. This is a stringent certification, and it is not easily found among payment processors. It takes about six months to complete, and the processor remains under a microscope as long as it has the certification.

PCI-certified organizations have more stringent standards that they need to comply with. If your payment processor is PCI-certified:

- A qualified security assessor (QSA) has inspected and approved of the software and the security measures taken to protect payment data.

- The QSA has looked into how the software solution was developed.

- The QSA checked the training process of the software developers.

- The security qualifications could have taken up to six months to complete.

It’s likely no surprise that we recommend a PCI-certified payment processor because the PCI certification process is rigorous and stringent regarding the guidelines that must be met.

Top 10 Payment Processors to Consider

Once you're armed with the education to compare vendors and match them to your nonprofit, you can begin to look at options. Here are ten solid choices; one is sure to be your perfect match.

1. CharityEngine: Best Overall Nonprofit Payment Processor

CharityEngine is a full-service, fully integrated nonprofit fundraising platform. It’s also a PCI-certified payment processor, meaning nonprofits enjoy utmost security, lower costs (no middlemen taking a cut at every stop), one-click giving, and even in-house ACH processing.

With almost every payment processor, nonprofits collect only 70% to 85% of their monthly sustainer revenue. The last 15% is chalked up to the standard losses from declined payments because payment processors can't capture that 15%.

CharityEngine has developed subscription billing technology specifically for nonprofits. Using SustainerIQ is guaranteed to increase revenue collection by over 90%, a promise no other payment processor can make.

All nonprofits can save money and be more efficient with CharityEngine's payment processing. But if you have at least 50 monthly donors, you'll really want to see CharityEngine in action.

2. Authorize.net: Good Fraud Protection

Visa owns this payment gateway and has heavy-duty fraud protection features. Authorize.net has been around for a while and allows customers to accept Discover, Visa, Mastercard, American Express, and PayPal and virtual wallets like Apple Pay.

Clients sometimes remark that transactions can be declined for minor reasons. It can be difficult to integrate into websites, and the fees can be higher than those of other payment gateways.

3. Stripe: Free Payment Processing

Stripe is used by millions of companies with different currencies across 47 countries. It’s easy to set up and provides details about all transactions. The dashboard is simple, and organizations of all sizes can use the solution.

People like that it’s free and easy to install, and they particularly like the variety of currencies it supports. However, there is significant backlash about transparency and customer service.

4. PayPal: Trustworthy with High Conversion Rates

PayPal has been shown to help increase nonprofit conversions by 32%, and 94% of all U.S. respondents agree that it’s a trustworthy payment option. It’s widely known for versatility, working as well to send cash to a friend, shop online, or donate to a nonprofit.

When dinged, PayPal is usually criticized for having higher fees than competitors. For many nonprofits, the higher conversion rates make it an acceptable trade.

5. Braintree: Good for Customization

A PayPal-owned processor, Braintree offers a customizable platform with advanced features such as recurring billing, multi-currency support, and mobile optimization. It also supports various payment types, including credit cards, PayPal, Venmo, and wallets like Apple Pay.

Tech-savvy nonprofits like Braintree for its flexibility and developer-friendly tools. However, it may be too complex for organizations without in-house tech support, and some users mention that customer service can be slow to respond.

6. iATS Payments: Good for Salesforce Users

iATS offers Brickworks by iATS, a Salesforce-native payment processing solution for nonprofits. It’s integrated into the Nonprofit Success Pack, so it’s a logical choice for nonprofits using Salesforce. The company provides secure, simple credit card and ACH processing.

Users complain that the website can be a bit clunky and the user interface seems a bit outdated.

7. Blackbaud Merchant Services (BBMS): Ideal for Blackbaud Users

BBMS is fully integrated with Blackbaud’s suite of nonprofit software products. It is designed specifically for nonprofits and offers PCI-compliant processing. It also provides secure credit card, debit card, and ACH transactions.

Nonprofits using Blackbaud’s CRM and fundraising platforms often appreciate the seamless integration with BBMS. However, if you're not totally in Blackbaud's ecosystem, there's a common concern about a lack of flexibility along with occasional reports of higher processing fees.

8. Square: Great for In-Person Donations

Square is well known for its mobile and in-person payment processing, which uses easy-to-use hardware and software. It’s popular with nonprofits that need to collect donations at events, galas, or pop-ups. Square supports credit cards, Apple Pay, Google Pay, and more.

While praised for its intuitive interface and lack of monthly fees, Square can be less suited for online-only fundraising campaigns. Also, its flat-rate pricing may be higher for high-volume nonprofits.

9. Clover: Versatile Point-of-Sale Option

Clover offers nonprofits a variety of point-of-sale (POS) hardware combined with robust payment processing features. It supports in-person and online payments and is known for its ease of use and flexibility across different types of events and campaigns.

While Clover is popular with nonprofits running thrift stores or regular in-person events, some nonprofits note that add-on fees can accumulate quickly, making it less appealing for smaller organizations or those that process mostly online donations.

10. WePay: Good for Platform Integration

Owned by JPMorgan Chase, WePay focuses on powering integrated payments for software platforms. It is often used within fundraising or event management platforms like GoFundMe Charity or Classy. It supports ACH, credit card payments, and digital wallets.

Nonprofits appreciate how easily WePay integrates into partner platforms. However, it offers little as a standalone processor, and users occasionally note slower fund disbursement times compared to other services.

Transform Fundraising With the Right Payment Processor

At the end of the day, the right payment processor isn’t just about moving money—it’s about maximizing impact. The fewer fees you pay and the more secure your donor data is, the more resources you can channel directly into your mission.

Whether you’re managing a handful of monthly donors or scaling to thousands, finding a partner who understands the nonprofit space can make all the difference. If you’d like to see how CharityEngine can help you keep more of every donation, streamline your operations, and strengthen donor trust, we’d love to show you.

.png)